“43% of the global high-net-worth population are women” – is your story inclusive?

Winning brands need be inclusive

In part 1 of this series, we looked at the power of brand storytelling in the wealth management sector. In this second part, we’ll explore the first of the audience segments that winning brands need to address as an integral part of their story: women with wealth.

This has been a challenging audience for the male-dominated wealth management industry to address. But it is an increasingly important segment for wealth managers to address, both in their marketing, and as part of their business model. Here’s why:

- 43% of the global high-net-worth population are women (Wealth-X World Ultra Wealth Report)

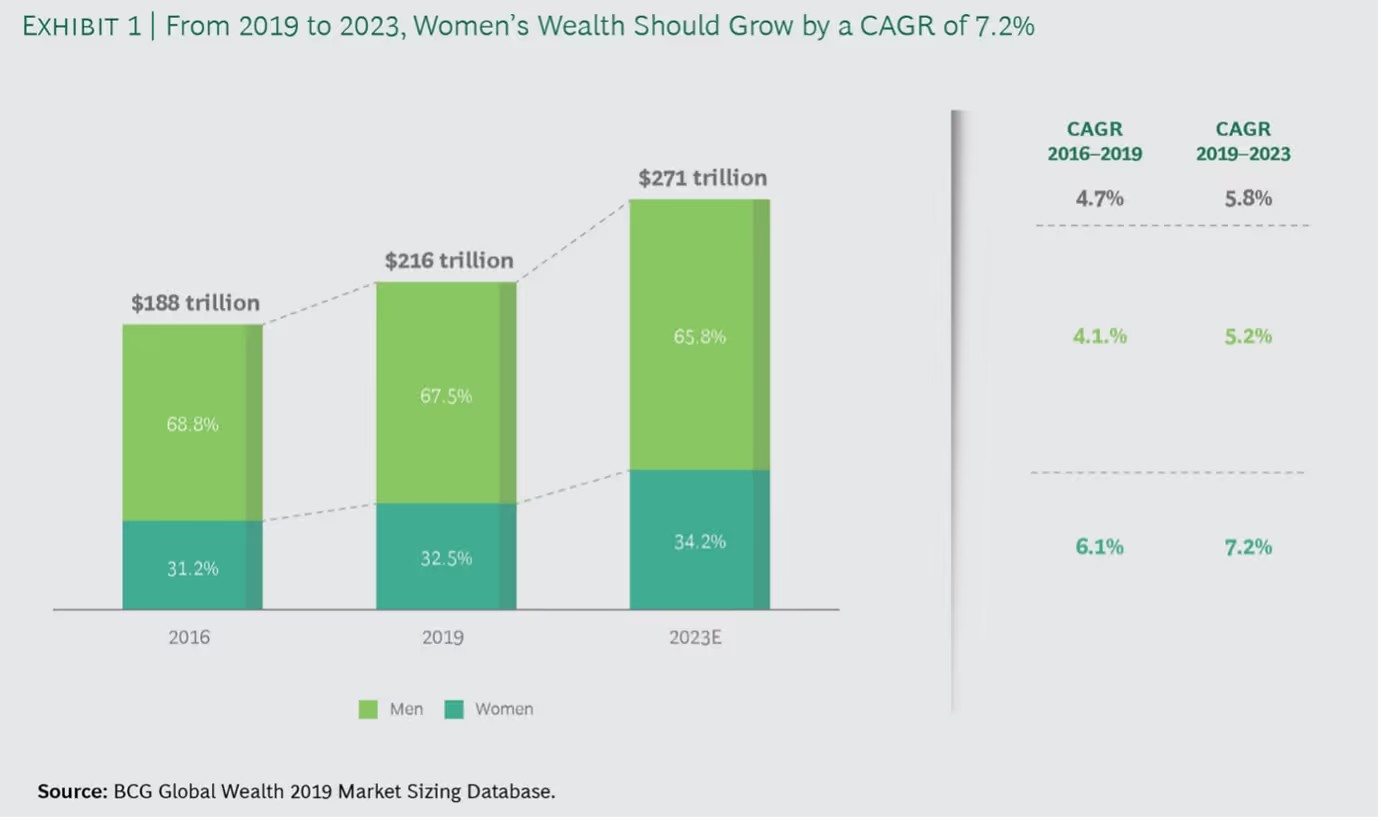

- From 2016 to 2019, women accumulated wealth at a compound annual growth rate (CAGR) of 6.1%.Over the next four years, Boston Consulting Group predicts that rate will accelerate to 7.2%

- Women, on average, are more attracted by a firm’s brand reputation than men: 49% vs 43% (Ernst and Young)

“…43% of the global high-net-worth population are women…”

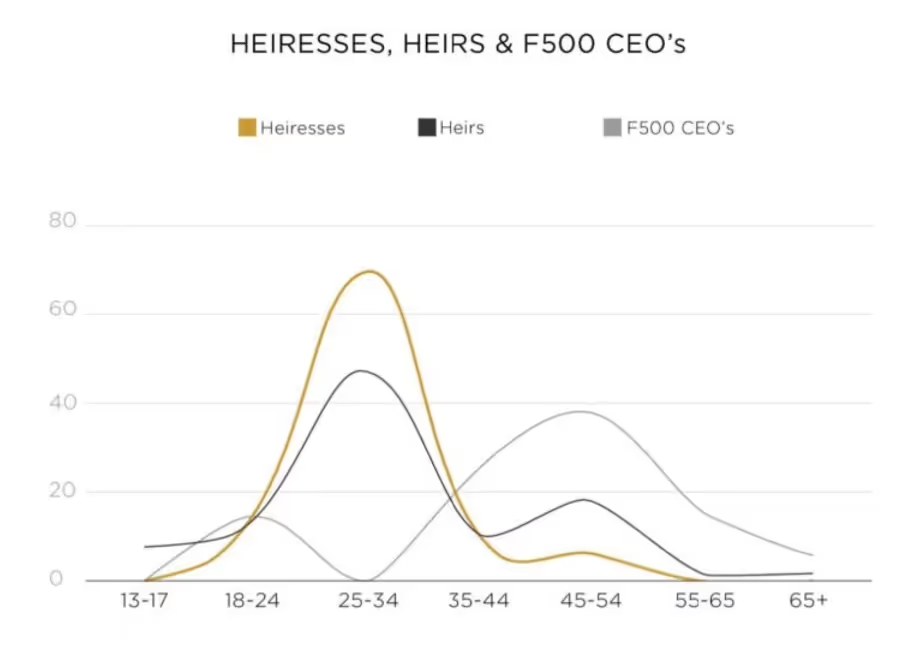

This wealth is being generated by more women in leadership roles, female entrepreneurs and female-led businesses. There is also a growing proportion of intergenerational wealth being passed to women, and the statistics show that many of them inherit between the age of 25-35. (source: BCG Global Wealth)

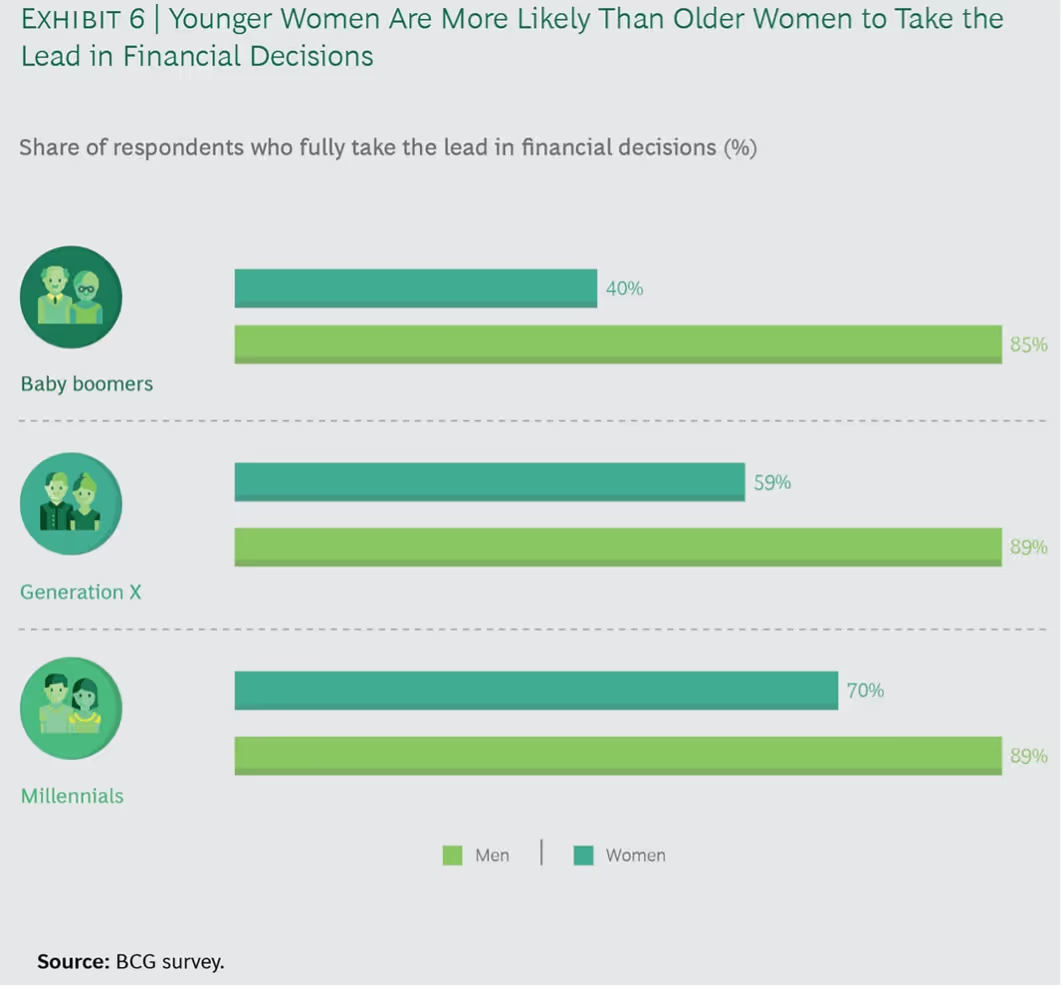

Across the board, Boston Consulting Group found that younger generations of women are taking control of their financial interests.

However, only two out of five women say they are confident making financial decisions, despite evidence showing that when women are deciding on investments, they often spend more time researching and gathering information than men.

Despite this growing opportunity, according to Ernst and Young, 73% of UK women feel their adviser misunderstands their goals or cannot empathise with their lifestyle. Consequently, the research found that 62% of women are willing to consider switching to another adviser compared with 42% of men.

“…70% of widows sacked their adviser after their husband’s death…”

The most profound of these statistics comes from Boston Consulting Group who found that 70% of widows sacked their adviser after their husband’s death.

So why is this?

You’d be forgiven for thinking that these women might prefer a female advisor, but that’s not necessarily the case.

Whilst wealth management is still a largely male-dominated sector (although this is changing slowly), according to a survey by Canada’s Strategy Marketing consultancy, only 7% actually wanted a female adviser.

Across the board, research studies show that women want advice that demonstrates an understanding of their approach and attitude to investing, as it is distinctly different to men.

“…73% of UK women feel their adviser misunderstands their goals…”

There’s been a lot of research published over the last ten years about what women want from a wealth management service. So it’s surprising to see how slow the industry has been in adopting its findings.

Especially considering that the audience makes up 43% of the addressable market. Even more so, when you consider how relatively simple it is to understand and address their needs.

Fundamentally women, unlike men, are not interested in investment performance for its own sake. UBS reports that women are more interested in what the money is for, rather than how it is invested. For them, it’s not a competitive pursuit in which data shows how much you’re winning or losing. Investing, for the majority of women, is about achieving their own personal goals.

Boston Consulting Group research summarised these goals as:

- Caring for themselves and family

- Improving their lives

- Ensuring stability

The specifics of these goals will change at different points throughout their life.

An overwhelming majority of women want their investments to benefit people, society and the planet. The Center for Talent Innovation (now Coqual) report that 88% of women want to invest in organisations that promote social wellbeing.

Along with these specific goals and aims, women’s mindsets are an important consideration. This means building trust is essential when advertising to women. The WealthyHer report found that:

- Women are not risk averse, they ask questions because they are risk aware

- Women are hungry for information and welcome investing education

- Women want clear, substantive and transparent advice

- Women value family meetings, including coaching children about financial matters

“…88% of women want to invest in organisations that promote social wellbeing…”

So how are wealth management brands reflecting these facts in their brand story? For us, there are two leaders.

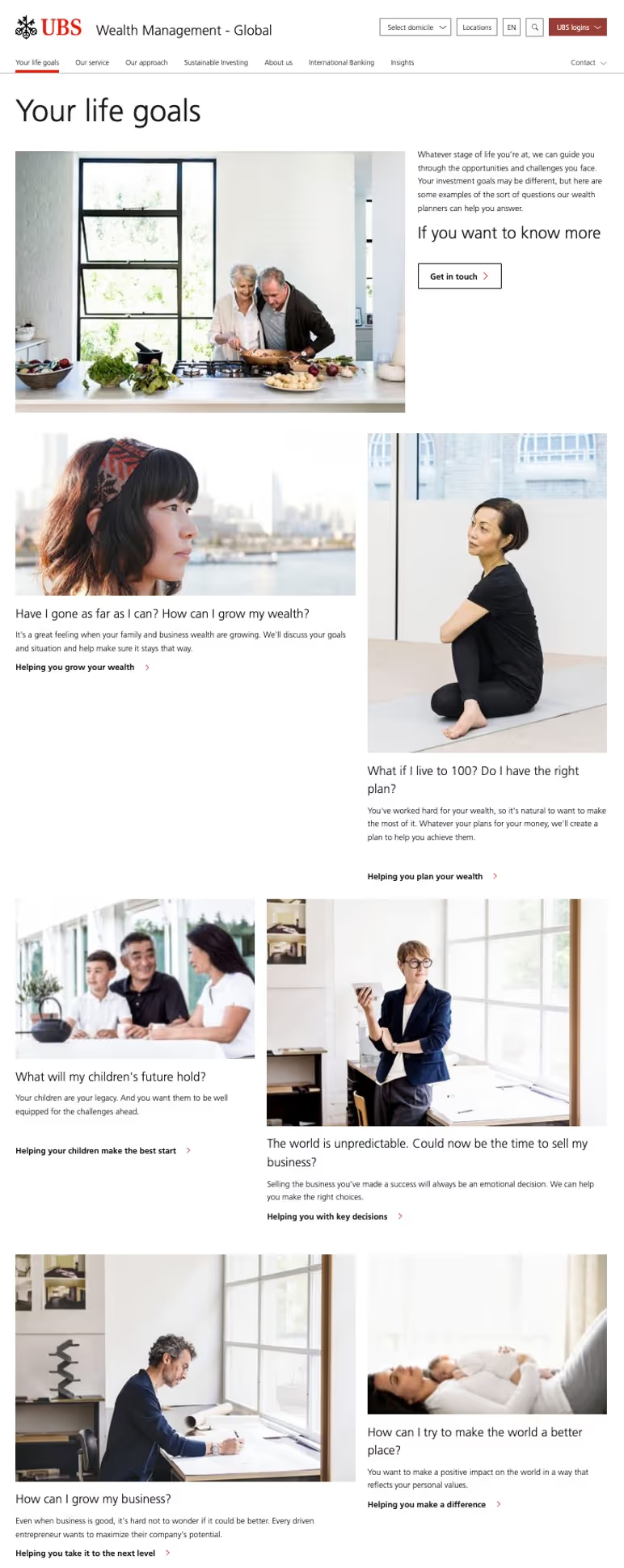

First, let’s look at UBS. They have applied a goal-orientated approach to their brand story, using the ‘questions’ narrative we discussed in Part 1 of this blog series across the customer journey.

The photography gives a sense that they are talking to both men and women. The goals and questions raised feel like they apply naturally to anyone. It never feels forced, contrived or patronising.

Having made their brand story broad and inclusive, they also create a specific journey for women. This includes advice services, online content, resources and communities aimed specifically at them.

ABRDN is the second leader, in our opinion. Whilst UBS is subtle and understated in its application, ABRDN is incredibly direct and concise. First, with sustainable investment as its headline message, it taps into the zeitgeist, particularly for women, as the research shows.

But then, look at the body copy. The core points from the research are all addressed. Again, this never feels contrived, forced or patronising. The brand has achieved an egalitarian position, equally appealing to men and women, young and old.

There are a growing number of niche wealth management companies aimed specifically at women, notably Independent Women, Wealth for Women, Women’s Wealth, Eva Wealth in the UK.

However, with increasing competition in the market, we expect to see more brands adopt a more inclusive narrative in their brand stories. The big test will, of course, be whether the service they offer lives up to their brand promise. Walking the talk will definitely be more challenging than creating the story.

"…we expect to see more brands adopt a more inclusive narrative in their brand stories…”

While we can’t necessarily help you practice what you preach consistently, we can certainly help you market to women. Our team of experts can advise you on brand strategy and inclusive storytelling, advertising campaigns and so much more. Get in touch by emailing marketing@proctorsgroup.com

And don’t miss the next blog in our Wealth Management series, all about marketing to millennials.